Dividend Adjustment

Achieve a clear view of your financial decisions with transparent trading.

What is a

dividend adjustment?

A dividend is a distribution of a portion of a company’s earnings to its shareholders, often issued as cash payments if you own the underlying shares. In CFD trading, dividend adjustments are made to minimize the financial impact and ensure fair value due to price changes on ex-dividend dates. These adjustments are directly applied to the trading account balance at the start of the trading day, either by crediting or deducting the corresponding amount.

Upcoming Dividend Adjustment

| Symbol | Description | Long Dividend | Short Dividend | Currency | Ex-Dividend Day |

|---|

Ex-Dividend Date

The ex-dividend date is the deadline by which a share must be owned to be eligible for the upcoming dividend. If a trader opens a share position after the ex-dividend date, they will not be entitled to receive the next dividend payment. Typically, this date falls one business day before the dividend record date.

Dividend Adjustment Application

Dividend adjustments are based on ex-dividend dates and company announcements. For CFDs, a long position will be credited while a short position will be deducted. In stock index trading, however, a 1% handling fee will be charged for adjustments. The adjustment will be automatically applied if a client opens a position after 00:05 (platform time) on the ex-dividend date.

Dividend Adjustment Calculation

Formula : Dividend per share x Contract size per lot x Volume (lots) = Dividend adjustment amount.

Dividend Adjustment Calculation

Formula : Dividend per share x Contract size per lot x Volume (lots) = Dividend adjustment amount.

Stocks

Scenario An open position with Nvidia shares on the ex-dividend date. Assuming 1 lot is equivalent to 100 contracts with dividend per share is calculated as USD 0.10

A long position adjustment calculation:

USD 0.10 x 100 contracts x 1 lot = USD 10

A short position adjustment calculation:

(USD 0.10) x 100 contracts x 1 lot = (USD 10)

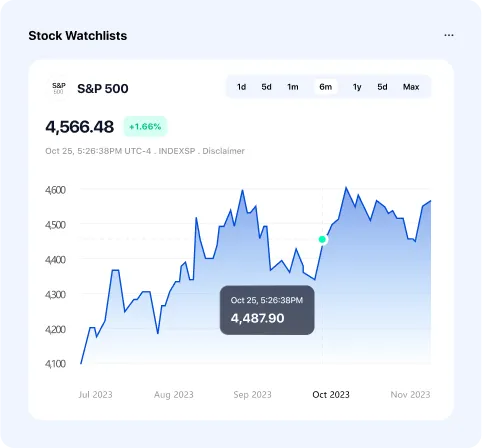

Indices

Scenario An open position in S&P 500 Spot Index on the ex-dividend date. Assuming 1 lot is equivalent to 100 contracts with dividend per share as USD 3.00

A long position adjustment calculation:

USD 3.00 x 100 contracts x 1 lot = USD 300.00

A short position adjustment calculation:

(USD 3.00) x 100 contracts x 1 lot = (USD 300.00)

Start Trading

with CG FinTech

Create Account